Hashimoto et al. defined the period from the 1970s, when the history of PTCA was performed, to the 1980s, when it took root in Japan, as the "founding period," followed by the introduction period from the 1990s to 2000, the growth period from 2000 to 2006, the maturity period from 2007 to 2016, and the decline period after that. The macro-environmental analysis of each historical background was analyzed from the four perspectives of politics, economy, society, and technology (PEST analysis). The background of the development of the cardiovascular industry, as well as the role of cardiovascular hospitals as a driving force, is described, followed over time by the decline in reimbursement prices that triggered a period of decline, the results of clinical research that reduced the value of PCI, social conditions, and technological innovations.

The number of national PCI cases and the size of the market continued to grow until 2010, but since then, even as the number of cases increased, the market has shrunk as reimbursement prices have fallen sharply. The market, which peaked at 140 billion yen, is now less than 80 billion yen, and this market is not expected to grow in the future.

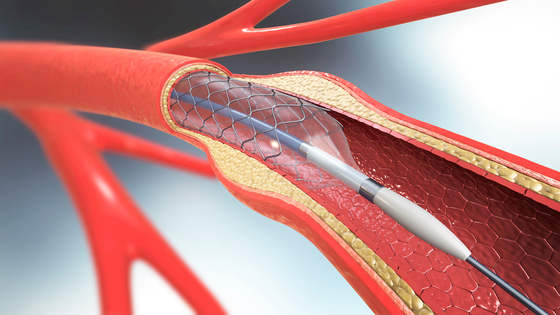

The players in this industry, consisting of medical device manufacturers, trading companies, distributors, wholesalers, and hospitals, built a major industry supported by the high reimbursement prices set by the government to promote the treatment from the 1990s to the early 2000s. However, the 2022 reimbursement price revision will reduce the price of a balloon catheter from about 300,000 yen to 32,000 yen in the 1980s, and the price of a drug-eluting stent from 421,000 yen to 136,000 yen when introduced in 2004 by about 90% and 70%, respectively, and the industry will be forced to consider how to make up for this decline. The choice is now between compensating for the decline and moving forward or exiting the market.

Hashimoto et al. note, "The decline of one market is a trend that can be observed in any industry, as evidenced by the steel industry, which was known as the rice of industry after World War II, and the semiconductor industry, which became "Japan as the number one" and the world's second largest economy in the late 1970s and later. We can learn from looking at how the players in these industries are surviving today. The catheter industry is undergoing a similar process of restructuring, mergers and acquisitions, and even hospital consolidation. With the COURAGE, ISCHEMIA, and REVIVED trials, the management of the industry's driving force, cardiology hospitals, is entering a new era.”

Hashimoto S, et al. Circ J. 2022; in press.